FAQs for customers

Customer portal

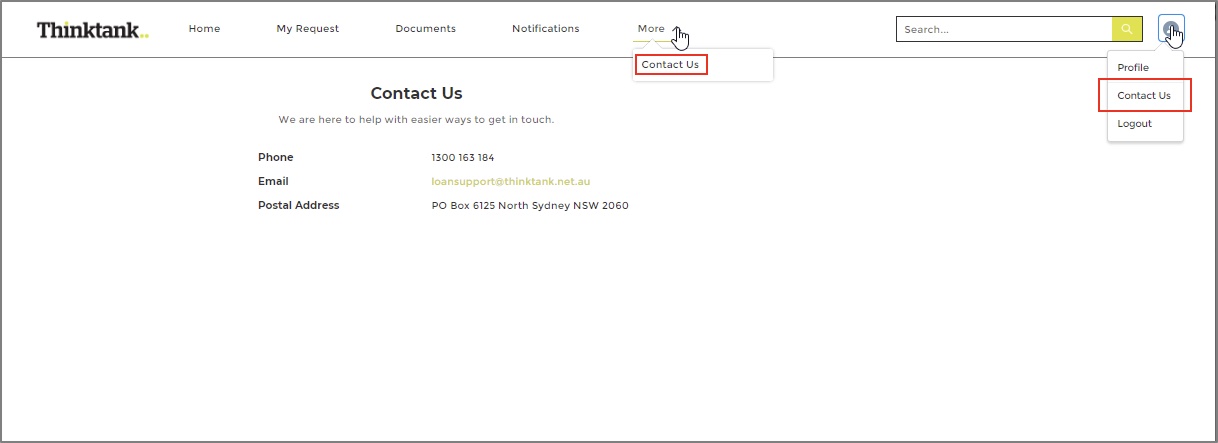

The Loan Support team are based in Sydney (Australia) and available from 8:30am-5:30pm AEST Monday to Friday. You can email loansupport@thinktank.net.au or call 1300 163 184 (cost of a local call anywhere in Australia), or +61 2 8669 5500 internationally. You can also find these details in the Customer Portal on the Contact Us, which can be found from the top menu or the login icon:

Applications and approvals

It’s helpful to be able to describe:

- the type of property being provided as security

- value of the property

- its location

- the required loan amount

- the loan purpose (purchase, refinance, equity release)

- other loans outstanding

- income available to service all liabilities

- whether tax returns and financial statements are available

- any other important information such as credit history

- Borrower background including income sources, business and experience.

Where all information supporting the loan application has been provided, we will typically provide a formal approval (subject to an independent valuation of the security property) within 3-4 business days. This may vary according to the complexity of the transaction.

Often it’s a good idea to have the property valued before applying for a loan, however, make sure the valuer is acceptable to the lender/s you’re considering using and that they’re prepared to re-address the valuation to the lender. Less than 10 per cent of borrowers take this approach and generally only for refinances or equity release.

We retain a diverse panel of experienced commercial property valuers and will appoint one to conduct an independent valuation on the property that is addressed to us. Our valuation instructions are the same for all loans and seek an assessment of current market value under normal buyer/seller circumstances.

An independent valuer appointed by us will inspect the property and assess its value based on:

- recent sales of comparable properties in the area or the “vacant possession” approach which is especially relevant to owner-occupied properties.

- a capitalisation approach that derives a value relative to the actual or likely rental income produced.

We will only take into account income as shown in financial statements and on bank statements or BAS returns. Unreported or unverifiable cash receipts will not be included in our loan servicing calculations (Not required for Quick Doc or Mid Doc loans).

Where a company or trust is a party to a loan, personal guarantees serve to ensure the responsibility for maintaining the loan extends to the key people who own and/or operate that entity. All loans not in personal names must be supported by the personal guarantees of all directors (some limited exceptions apply including SMSF loans less than 50% LVR).

It’s vital that all borrowers receive sound, impartial advice prior to signing loan documentation particularly in relation to personal guarantees. With recent changes in land and property legislation, solicitors play an important role in verifying the identity of the parties signing the mortgage which is now required by most states and territories.

This second step serves to meet a legal requirement for solicitors witnessing the signing of mortgage documentation to confirm the identification of those parties to the loan.

Borrowing and security

Minimum population base of 20,000 applies in security locations for most of our product range. Some loan products including Quick Doc sees this requirement increase to 50,000.

We’ll lend against typical residential and income producing commercial properties such as shops, offices, industrial units, warehouses and some other specialised commercial premises. Please refer to our Eligible Security Types information sheet.

We don’t lend against some specialised properties such as aged care, sporting facilities, service stations, caravan parks, rural, agricultural or properties in remote/arid regions or construction/development properties. Please refer to our Eligible Security Types information sheet.

Vacant land isn’t acceptable as primary security. We’ll only accept vacant land where it’s used as supporting security in addition to a typical commercial property of greater value.

No, we only lend against completed commercial and residential properties.

Non-resident Australian citizens can apply for a loan with us as long as they have on-shore income sufficient to meet our debt servicing criteria. Please note that servicing criteria for non-residents varies from standard loan servicing criteria.

Yes, we now provide home loan finance for owner-occupiers and investors within our Full Doc and Mid Doc product range to both PAYG and self employed borrowers.

Yes, we finance residential rental property for a range of purposes including owner-occupied and investment to PAYG and self employed borrowers.

Industry associations, the MFAA and the FBAA, both offer referrals to qualified finance brokers. Alternatively, we’ll be happy to refer you to an accredited Thinktank finance broker in your area.

Yes, we offer loans to self managed superannuation funds up to $3 million and 75% LVR. Please refer to our Overview of SMSF Commercial Loans.

No, we don’t offer non-conforming, sub-prime or no doc loans.

We don’t provide traditional overdraft facilities but do offer a Line of Credit facility up to $500,000.

Interest rates

On Tuesday 2 August 2022, the Reserve Bank of Australia (RBA) announced an increase to the official cash rate by 50 basis points to 1.85%.

In light of this, Thinktank announced a 0.60% per annum increase to all variable loan interest rates, for new and existing borrowers.

Our aim is to always provide value for our customers, whilst also balancing the cost associated with funding residential and commercial loans while maintaining prudent operational management of Thinktank as a responsible financial institution.

Thinktank advertises interest rate changes in the national newspaper The Australian. The rate increase will impact your variable loan repayment. Customers should expect to receive a letter notifying them of the change, the new repayment amount and the effective date of the change.

Interest rate changes will affect the amount of the direct debit deduction set up for your loan. If your direct debit repayment is scheduled to occur monthly, then your repayment will increase automatically to accommodate for the rate change. Therefore, no action is required.

If your direct debit is set up for weekly or fortnightly payment deductions at the minimum repayment amount or your direct debit is set to a fixed amount, you will be required to adjust your current payments in line with the above changes to ensure it is sufficient to cover your new monthly repayment amount as stipulated on the rate change notification. If you would like to adjust your repayment, please email Loan Support loansupport@thinktank.net.au, or call us on 1300 163 184.

- Repay only the minimum amount – which could free up extra cash in the short term.

- Repay more than the minimum – over time you will reduce the amount of loan interest and pay your loan off sooner.

- Change repayment frequency – we offer weekly, fortnightly or monthly payment options.

- Switch between Principal & Interest and Interest Only repayments (subject to credit approval).

My loan

For interest only loans, interest is calculated one month in advance based on the loan balance and borrower interest rate on that day. Interest on principal and interest loans is calculated daily in arrears.

Yes, however please note, that your loan may attract a break cost or/ and an early repayment fee. To identify whether your loan is subject to a break cost or/ and an early repayment fee please check your Loan Offer and Facility Terms & Conditions. Should you require any assistance please contact our Loan Support Team by email loansupport@thinktank.net.au or phone 1300 163 184.

Yes, we offer fixed rates between one and five years.

If your loan isn’t fully drawn or you have made extra repayments, redraw is available on all variable rate loans except for SMSF loans where redraw is not permitted under super fund legislation.

A redraw form is available for download from our helpful forms and tools.

You’ll receive a loan statement every six months in early January and early July. If you require transaction information more frequently, you can gain internet access to all your loan information.

Dispute Resolution Procedures

We hope you are satisfied with our products and service. If you are not, please first speak to your nominated representative or telephone 1300 781 043 and ask to speak to the Compliance Officer. If you are not satisfied with any decision or our handling of the complaint, your complaint may be referred for external resolution to the Australian Financial Complaints Authority. Their contact details are set out below.

Australian Financial Complaints Authority (AFCA)

Post: GPO Box 3 Melbourne VIC 3001

Phone: 1800 931 678

Email: info@afca.org.au

Web: www.afca.org.au

Additional information in relation to AFCA including rules and guidelines are available from their website.